Invisalign treatment is a modern orthodontic method that uses clear, removable aligners to straighten teeth and correct bite issues. Patients wear custom-made aligners for 20-22 hours daily, changing them every 1-2 weeks as teeth gradually shift. This treatment offers a discreet appearance and allows for easy removal during eating and oral hygiene routines.

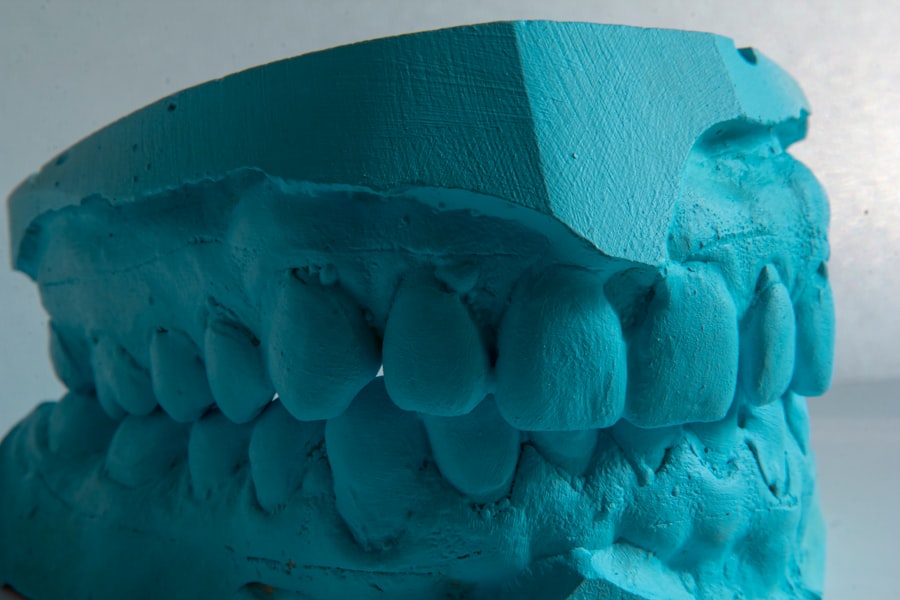

The process begins with a consultation with an Invisalign-certified provider who assesses the patient’s dental needs. The provider creates a customized treatment plan using impressions, x-rays, and photographs to develop a 3D digital model. This model guides the design of the aligners and plans the teeth’s movement.

Patients receive new sets of aligners periodically and attend follow-up appointments to monitor progress. Invisalign is suitable for teens and adults, addressing various dental issues such as crowded teeth, gaps, overbites, underbites, and crossbites. Treatment duration typically ranges from 12-18 months, depending on the case complexity.

This method provides a comfortable and inconspicuous alternative to traditional braces for achieving improved dental alignment and oral health.

Key Takeaways

- Invisalign treatment involves using clear aligners to straighten teeth and is a popular alternative to traditional braces.

- Dental insurance typically covers a portion of the cost for orthodontic treatment, including Invisalign, but the coverage varies depending on the plan.

- Invisalign treatment may qualify for coverage under dental insurance, but it’s important to check with the insurance provider to understand the specific terms and conditions.

- When using dental insurance for Invisalign, factors to consider include coverage limits, deductibles, and out-of-pocket expenses.

- Alternatives to using dental insurance for Invisalign include flexible spending accounts (FSAs) or health savings accounts (HSAs) to help cover the cost.

- To maximize dental insurance benefits for Invisalign, it’s important to understand the coverage details, submit claims promptly, and explore any available discounts or payment plans.

- Making informed decisions about Invisalign treatment and dental insurance involves researching coverage options, understanding costs, and consulting with a dental professional for personalized advice.

What Does Dental Insurance Cover?

Preventive and Basic Services

Preventive services, such as routine cleanings, exams, and X-rays, are usually fully covered or require a small copayment. Basic services, including fillings and extractions, are often covered at a percentage, such as 80%.

Major Services and Orthodontic Treatment

Major services like crowns, bridges, and root canals may be covered at a lower percentage, such as 50%. Orthodontic treatment, such as braces, is considered a major service and may have separate coverage limitations.

Plan Limitations and Restrictions

Dental insurance plans often have annual maximums, deductibles, and waiting periods for certain services. The annual maximum is the maximum amount that the insurance will pay for dental care within a year, typically ranging from $1,000 to $2,000. The deductible is the amount that the patient must pay out of pocket before the insurance coverage kicks in. Waiting periods may apply to certain services, meaning that the patient must wait for a specific period before being eligible for coverage. Some plans may have restrictions on the type of orthodontic treatment covered or may require pre-authorization before starting treatment. Patients should also be aware of any network restrictions and whether they need to see an in-network provider to maximize their benefits.

Does Invisalign Treatment Qualify for Coverage?

Invisalign treatment is considered a form of orthodontic treatment, which falls under the category of major dental services in most dental insurance plans. As such, coverage for Invisalign treatment may be subject to limitations and exclusions outlined in the patient’s insurance policy. Some dental insurance plans may not cover orthodontic treatment at all, while others may have specific criteria that must be met for coverage to apply.

Patients considering Invisalign treatment should review their dental insurance policy or contact their insurance provider to determine if Invisalign is a covered benefit. They should inquire about any restrictions or requirements for coverage, such as age limitations, pre-authorization requirements, or the need to see an in-network provider. It’s also important to understand the extent of coverage, including any percentage of costs covered and any annual maximums that may apply.

In some cases, dental insurance plans may cover a portion of the cost of Invisalign treatment, particularly for patients under a certain age or with documented orthodontic needs. However, patients should be prepared for the possibility that they may have out-of-pocket expenses for Invisalign treatment, especially if their insurance plan has limitations on orthodontic coverage.

Factors to Consider When Using Dental Insurance for Invisalign

| Factors to Consider | Description |

|---|---|

| Coverage | Check if your dental insurance plan covers Invisalign treatment |

| Out-of-pocket costs | Consider the amount you will need to pay for co-pays, deductibles, and any additional costs |

| Network providers | Find out if there are in-network providers for Invisalign treatment within your insurance plan |

| Pre-authorization | Determine if pre-authorization is required by your insurance company before starting treatment |

| Annual maximum | Check if there is a maximum amount that your insurance will pay for orthodontic treatment each year |

When considering using dental insurance for Invisalign treatment, there are several factors that patients should take into account. First and foremost, patients should carefully review their dental insurance policy to understand the extent of coverage for orthodontic treatment, including any limitations or exclusions that may apply. This can help patients anticipate potential out-of-pocket costs and make informed decisions about pursuing Invisalign treatment.

Patients should also consider whether their preferred Invisalign provider is in-network with their dental insurance plan. Seeing an in-network provider can help maximize insurance benefits and reduce out-of-pocket expenses. If the provider is out-of-network, patients should inquire about any potential impact on coverage and costs, as some insurance plans may offer reduced benefits or require higher copayments for out-of-network care.

Another important factor to consider is the age of the patient seeking Invisalign treatment. Some dental insurance plans have age limitations for orthodontic coverage, which may impact eligibility for coverage. Patients should verify whether there are any age restrictions in their insurance policy and how they may affect coverage for Invisalign treatment.

Additionally, patients should be aware of any pre-authorization requirements for orthodontic treatment under their dental insurance plan. Pre-authorization may be necessary to confirm the medical necessity of Invisalign treatment and ensure that it meets the criteria for coverage. Patients should follow any required steps for pre-authorization to avoid potential denials of coverage.

Alternatives to Using Dental Insurance for Invisalign

For patients who do not have adequate dental insurance coverage for Invisalign treatment or who do not have dental insurance at all, there are alternative options to help manage the cost of treatment. Many Invisalign providers offer flexible payment plans or financing options to help patients spread out the cost of treatment over time. These plans may offer low monthly payments or interest-free financing for a certain period, making it more manageable for patients to afford Invisalign treatment.

Patients may also consider using a health savings account (HSA) or flexible spending account (FSA) to pay for Invisalign treatment with pre-tax dollars. These accounts allow individuals to set aside money for qualified medical expenses, including orthodontic treatment, and can provide tax advantages by reducing taxable income. Patients should check with their benefits administrator or financial advisor to determine if they are eligible to use an HSA or FSA for Invisalign expenses.

Another option for managing the cost of Invisalign treatment is to explore third-party financing companies that specialize in healthcare financing. These companies offer loans specifically designed for medical and dental expenses, including orthodontic treatment. Patients can apply for financing through these companies to cover the cost of Invisalign treatment and make affordable monthly payments over time.

How to Maximize Dental Insurance Benefits for Invisalign

Choose an In-Network Provider

Patients with dental insurance coverage for Invisalign treatment can take steps to maximize their benefits and minimize out-of-pocket expenses. One way to do this is by choosing an in-network Invisalign provider who participates in the patient’s dental insurance plan. Seeing an in-network provider can help ensure that patients receive the highest level of coverage and minimize their out-of-pocket costs.

Understand Your Annual Maximum Benefit

Patients should also verify their annual maximum benefit under their dental insurance plan to understand how much coverage they have available for orthodontic treatment like Invisalign. By timing their treatment strategically and utilizing their annual maximum over multiple years if necessary, patients can make the most of their insurance benefits and reduce their overall expenses.

Stay Informed and Keep Track of Expenses

It’s important for patients to stay informed about their dental insurance plan’s requirements for pre-authorization or any other necessary steps to confirm coverage for Invisalign treatment. By following these requirements and providing any requested documentation or information, patients can help ensure that their insurance benefits are applied appropriately to their Invisalign treatment. Additionally, patients should keep track of their out-of-pocket expenses related to Invisalign treatment, including copayments, deductibles, and any costs not covered by insurance. These expenses may be eligible for reimbursement through a flexible spending account (FSA) or health savings account (HSA), providing additional financial relief for patients undergoing Invisalign treatment.

Making Informed Decisions About Invisalign Treatment and Dental Insurance

When considering Invisalign treatment and dental insurance coverage, it’s important for patients to make informed decisions that take into account their individual needs and financial considerations. Patients should carefully review their dental insurance policy to understand what is covered and any limitations that may apply to orthodontic treatment like Invisalign. Patients should also consult with their preferred Invisalign provider to discuss payment options and potential financing arrangements that can help make treatment more affordable.

By exploring alternative financing options and maximizing their dental insurance benefits, patients can make Invisalign treatment more accessible and manageable from a financial perspective. Ultimately, the decision to pursue Invisalign treatment should be based on achieving optimal oral health and a confident smile. Patients should weigh the potential benefits of Invisalign against the cost of treatment and explore all available resources to help make their orthodontic journey a positive experience.

By staying informed and proactive about their options for financing and insurance coverage, patients can take proactive steps towards achieving a straighter smile with Invisalign.

If you’re considering Invisalign treatment and wondering if your dental insurance will cover it, you may want to check out this article on hunterlynnhair.com. It provides valuable information on how dental insurance typically handles Invisalign and what options you may have for coverage. Understanding your insurance benefits can help you make an informed decision about pursuing Invisalign treatment.

FAQs

What is Invisalign?

Invisalign is a type of orthodontic treatment that uses clear, removable aligners to straighten teeth.

Does dental insurance cover Invisalign?

Some dental insurance plans may cover a portion of the cost of Invisalign treatment, but coverage varies widely depending on the specific plan. It’s important to check with your insurance provider to understand the details of your coverage.

What factors determine if Invisalign is covered by dental insurance?

The coverage for Invisalign treatment by dental insurance depends on the specific plan, the type of treatment needed, and the individual’s policy details. Some plans may cover a portion of the cost for orthodontic treatment, including Invisalign, while others may not provide any coverage.

What should I consider when looking into Invisalign coverage with dental insurance?

When considering Invisalign treatment and dental insurance coverage, it’s important to review your policy details, including any limitations, exclusions, and maximum benefit amounts for orthodontic treatment. Additionally, it’s advisable to confirm coverage and estimated out-of-pocket costs with your dental insurance provider and the Invisalign provider.

Are there alternative payment options for Invisalign if it’s not covered by dental insurance?

If Invisalign treatment is not covered by dental insurance, there are alternative payment options available, such as flexible spending accounts (FSAs), health savings accounts (HSAs), payment plans offered by the Invisalign provider, or seeking financing options through third-party providers. It’s recommended to discuss these options with the Invisalign provider.